Being the targeted parent of parental alienation is difficult — especially because it’s brought on without you having any say in the matter. But it’s even more challenging to address and deal with during the school year when you and your child have limited time together and want to make every moment worthwhile.

Last month, we discussed who should consider prenuptial agreements. Throughout that discussion, we learned that nearly everyone could benefit from prenups if they have any property or financial commitments.

Learning as much as possible before committing to an agreement is necessary. Learning how to create a prenup and the consequences of not creating one are essential considerations before working with your attorney to write a prenuptial agreement.

How to Create a Prenup

Depending on your situation, a prenup can help protect you and your assets in the future. Thankfully, creating a prenup is simple. There are two main ways to create a prenup:

1. You can work with your lawyers to create a document.

2. You can create a prenup yourself.

Working With Lawyers to Create a Prenup

If you decide to work with lawyers to create your prenup, you get legal advice throughout the process. Along the way, you’ll need to share your financial information with them to create a better prenup that’s fair and equitable.

Lawyers know that the perception of prenups is changing in the court’s mind positively, but they will quickly dismiss unfair prenups.

Creating a Prenup Yourself

If you and your partner want to create a prenup on your own, you’re more than capable of doing so. Several websites and programs help you create a comprehensive and legitimate prenuptial agreement.

Even though both of you may agree to the prenup terms, each partner needs to bring a copy to a different lawyer and receive advice regarding the prenup.

The reason for meeting with different lawyers is two-fold:

1. They review the agreement from a lens of what best helps you should there be a divorce.

2. Courts rarely follow through with a prenuptial agreement if lawyers didn’t review it beforehand.

The last thing you want is to go through the effort of creating an agreement only for the courts to dismiss it.

What Happens if You Don’t Create a Prenup and Divorce?

Not all couples choose to create a prenup. For the longest time, many people viewed prenups as a document that ensured your marriage wouldn’t last. In other words, people thought you were planning to split up before you married.

That’s no longer the case. As men and women are much more equal in today’s society than in the past, the courts view prenups as more fair because they include the assets of both sides. It’s not just about one person trying to take the wealth of another.

If you decide to forego a prenup and divorce your spouse, your belongings before marriage and those accrued during your marriage will split between you and your spouse.

Conclusion

As the public and legal perception of prenuptial agreements continue to shift in favor of the document, couples must learn how to create a prenup and the potential consequences of not creating one.

If you need an attorney to help you start the prenup conversation or to review your documents, contact Hickey and Hull Law Partners. We can get your marriage and finances started on the right foot.

Losing a job is an unfortunate reality for many Arkansans. When you enter the workforce, it's a possible outcome, regardless of your field. What makes it more difficult is when the layoff comes unexpectedly.

Whether you watch live news, movies, or television shows, you’ve probably heard of different crimes. Even though some are more common than others, there are clear distinctions between each crime class requiring different systems and punishments.

Use this guide to help you better understand the seven types of crime so you know the best way to protect yourself.

Type 1: Crimes Against a Person

These violent crimes are directed toward another individual or group of people intending to harm. In most cases, crimes against a person separate into two categories: homicide and physical crimes.

Physical crimes include:

· Assault and battery

· Arson

· Child abuse

· Domestic abuse

· Kidnapping

· Rape and statutory rape

Type 2: Crimes Against Property

As its name states, this crime is against a person’s property. Property crimes include:

· Lawns

· Homes

· Vehicles

· And anything else a person owns.

When a person commits a crime against property, they’re trying to inflict pain on the individual who owns the property without physically hurting the person.

Type 3: Inchoate Crimes

When we hear about crimes of conspiracy or intent, officials are talking about inchoate crimes. These crimes never manifest themselves because law enforcement stopped them in time.

The punishment for these criminal offenses are on a case-by-case basis. Sometimes the punishment is as severe as if the person committed the crime, whereas other punishments are less severe.

Type 4: Statutory Crimes

A statute is a written law, so statutory crimes are those committed against the law. Most statutory laws are designed to prohibit the abuse of certain freedoms.

Although crimes listed above fit under this category, there are other crimes included, like:

· Alcohol crimes

· Drug crimes

· Trafficking

· White collar

The severity of punishment for these crimes often lies in the damage caused by the crime. For example, DUI resulting in vehicular homicide will bring more charges and a longer prison sentence than DUI, where an officer pulls you over.

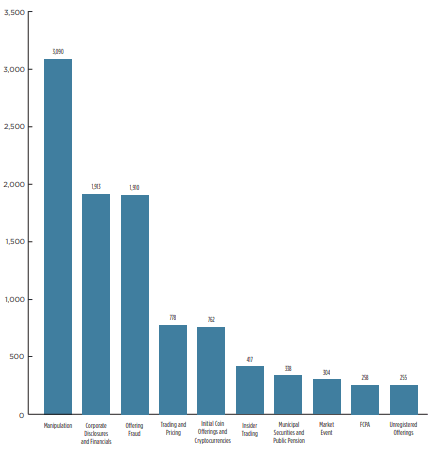

Type 5: White-Collar Crimes

White-collar crimes are also known as financial crimes, and those who commit these crimes are traditionally those of higher corporate positions.

Common white-collar crimes include:

· Fraud

· Blackmail

· Embezzlement

· Money laundering

· Tax evasion

· Cybercrime

Type 6: Organized Crime

Organized crime is one of the most common types on television and in movies. We often affiliate organized crimes with the Mafia, but there are other ways to commit an organized crime.

In short, organized crime is when a group of people unite and control illegal goods, services, and products that often generate a lot of money.

Type 7: Hate Crimes

Hate crimes have a long history when you look at recorded world history. Hate crimes require a person to take action against another person because of their religion, race, gender, beliefs, or disability.

What Should You Do if You’re Charged With a Crime?

If you’re ever charged with a crime, you must learn the type of crime officers have stated. Although you’ll want legal representation regardless of the type of crime, you should find a lawyer who can help you with your charges.

At Hickey and Hull Law Partners, we’re experienced in most of these crimes and are prepared to help you fight your case. Don’t trust any other lawyer in Northwest Arkansas. Contact Hickey and Hull today to start your defense process.

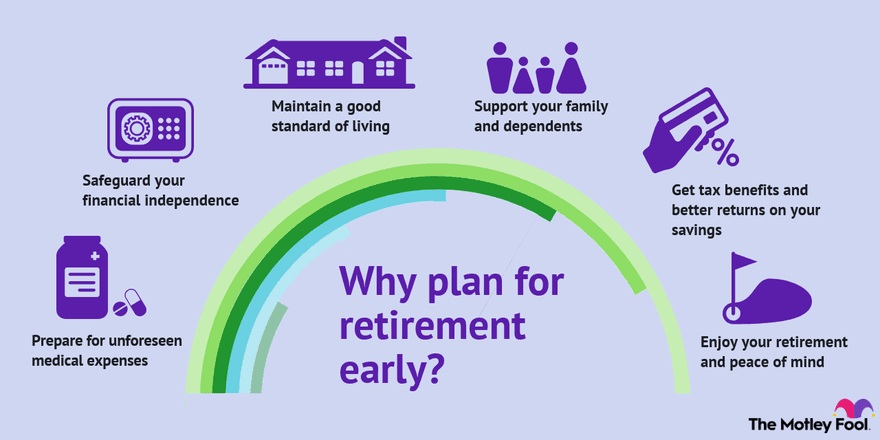

Everyone knows that retirement planning is essential and that the earlier you start, the better. But it’s shocking how few start saving for retirement in their 20s–a whopping 39%. Some people even wait to start saving once they’re in their 50s. Although we don’t recommend waiting this long, it’s always better to start saving today than to dwell on the past.

Whether you’re in the saving and planning grind or just starting your retirement savings journey, here’s what you need to know.

Determine How Much Money You Need Each Year You’re Retired

To save for retirement, you must have a monetary goal. Although it would be great never to have to worry about money, most retirees must live on a budget to ensure their retirement savings last long enough.

Image Source: https://www.fool.com/retirement/

Although your income can change throughout your life, especially if you’re starting your retirement planning early, plan to save 70-90% of your monthly income for each year in your retirement account. In other words, if you make $50,000/year, you want to live each year in retirement on approximately $40,000 (80% in this example).

Knowing how much you need for each year of retirement helps you find retirement plans that best meet your goals and needs.

Find Retirement Plans That Work for You

There isn’t a single retirement account available that’s better than others for you–they all have their benefits, which is why you need to work with a financial advisor and lawyer to determine which retirement accounts help you the most.

Many companies offer employer sponsored retirement plans, like 401Ks, but that shouldn’t be your only retirement savings account. Additionally, some businesses don’t offer this kind of planning at all.

Regardless, you should seek other options to help you build a retirement planning portfolio. Consider these plans with your advisors and lawyers:

- 401(k)

- Roth IRA

- Traditional IRA

- Self-directed IRA

- Simple IRA

- SEP IRA

- Solo 401(k)

Some of these plans are tax deductible, have low interest rates, and earlier accessibility dates. Using multiple retirement plans helps you be conservative in some plans while attempting a more aggressive option with others.

Select Your Plans and Start Saving Today

Once you find what works for you and your future, commit to those plans. If you’re married, ensure your spouse sets up their individual retirement accounts alongside you. Working together doubles your retirement income and gives you an accountability partner throughout the process.

Commit to saving retirement money every month and stay motivated. Although it might be easy to skim a few dollars here and there from your committed pile of cash before it goes into a retirement plan, please don’t do it.

Depending on your age, those few dollars can turn into hundreds, thousands, and even millions after several decades. Those few dollars will benefit you greatly during retirement age.

Conclusion

There are dozens of options available when looking for retirement plans. Whether you’re in your 20s or starting to save in your 50s, Hickey and Hull can help you make the best financial decisions for your future estate.

Call us or visit today to learn how we can help you get on the right track with your estate and finances so that you can enjoy retirement.

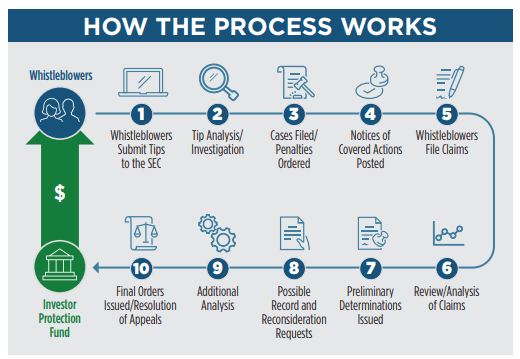

Tattle-tale. Rat. Traitor. Informant. Snitch. Spy.

These are just some of the words people use to describe whistleblowers, and they're wrong by all accounts of the actual definition. A whistleblower isn't any of these synonyms.

A whistleblower is essential in holding management, businesses, and government agencies accountable for their actions and negligence. Continue reading to learn more about whistleblowers and how OSHA works to protect these individuals from retaliation.

The Definition of a Whistleblower

A whistleblower is someone who speaks up about unsafe working conditions and other workplace issues for all employees.

In 2021, whistleblowers played a vital role in the success of businesses and assists the Department of Justice enforce safety codes. Without whistleblowers, work conditions would deteriorate, and many employees would suffer physical, emotional, mental, and financial harm.

Because whistleblowers seek to protect their fellow employees, upper management doesn't like these individuals. When someone reports unsafe working conditions to OSHA, the company goes under incredible scrutiny, which can often result in retaliation against the employer.

How Does OSHA Protect Whistleblowers?

OSHA understands that when people expose their companies, politicians, and businesses due to unsafe conditions and wages, they isolate themselves and become a target for retaliation.

Because a business and powerful individuals have more contacts and connections, OSHA must step in to protect the whistleblower from retaliation. Various forms of retaliation, according to the US Department of Labor, include:

· Firing or laying off,

· Demoting,

· Denying overtime or promotion,

· Denying benefits,

· Intimidation or harassment,

· More subtle actions, such as isolating, ostracizing, mocking, or falsely accusing the employee of poor performance,

· And many more. All of these recourses in response to a whistleblower are illegal. Therefore, the US Consumer Product Safety Commission implemented the Whistleblower Protection Act (WPA) and Whistleblower Protection Enhancement Act (WPEA). The United States government uses these whistleblower protections to ensure that whistleblowers don't suffer any retaliation for their actions.

How to File a Complaint

If you notice certain workplace conditions, behaviors, policies, and wages are below industry standards and don't meet OSHA standards, you may want to file a complaint.

Additionally, you can file a complaint if you believe your superiors retaliated against you following your whistleblowing. In either case, following these steps is best to protect your job, future, and family.

Unless there is abuse, neglect, or other legal reasons, each parent gets to spend time with their child(ren) after a divorce. If the parents can work through their differences together, they will decide how much each parent spends with the children.

This organizational strategy is a parenting plan and is exceptional at helping parents and children know what to expect throughout the year.

Although helpful, a parenting plan can be challenging because there are many aspects to include. Use this guide to help you jumpstart your plan.

What is a Parenting Plan?

A parenting plan is a schedule that informs parents and children about their location, travel, and responsibilities throughout the year.

A parenting plan includes many things, like:

· Visitation schedules

· Appointments

· Legal custody arrangements

· Physical custody arrangements

· Finances

· Parenting time

· Child support

· And anything else you and your ex decide to include

Although children won’t necessarily get a say in the plan, especially if they’re much younger, parents should design the schedule to accommodate them.

In essence, parenting plans detail everyday life for a family even though they’re split among two households.

Why Do We Need a Parenting Plan?

As previously mentioned, as long as there aren’t any legal reasons for separation (abuse or violence), every couple should put together a parenting plan.

Parenting plans simplify decision-making and help everyone involved know the schedule.

This co-parenting tool is excellent for minimizing frustrations and disagreements between parents.

Tips for Writing Your Parenting Plan

Writing a parenting plan is challenging and takes several days and weeks to complete. Although you can get the bulk of your ideas written down in an afternoon, you should spend plenty of time discussing things with your ex to determine what’s best for the children.

The more time spent determining the fine details, the easier life will be in the future when an emergency arises.

Tip #1: Determine Time Splits

The first thing to figure out is when your child(ren) will spend time with one parent. Consider schedules, school, travel, vacations, and holidays.

Children must spend quality time with the other parent and have a substantial amount of visitation throughout that year that meets their needs.

Tip #2: Consider Legal and Physical Custody Arrangements

The judge will rule on legal and physical custody arrangements during the divorce process. You must include these rulings in your parenting plan.

When it comes time to decide on schools, medical care, or emergencies, both of you need to know who can make those calls.

Tip #3: Use Helpful Tools

The best-laid plans are useless if you can’t easily access the information. There are many helpful tools available to make your plan.

Consider using: · Google Calendar · Passion Planner · The Focus Course Digital Planner · The Ultimate Digital Planner

These tools are easily accessible and include room for notes and contact information in emergencies.

Conclusion

Writing a parenting plan is challenging but necessary for the courts and your future.

With a well-thought-out plan, you, your children, and your ex can all happily live life knowing important schedules, events, and vacations.

If you need help building a plan, contact Hickey and Hull Law Partners to help you begin writing your plan.

Last month, we shared part 1 of this series addressing proven methods to reverse the effects of parental alienation syndrome.

There are hundreds of thousands of weddings every year. Unfortunately, nearly 50% of marriages end in divorce over the last several decades. Although there are several reasons for this, most people are unprepared for divorce–only 5% of couples get a prenuptial agreement.

Prenups have a stigma about them that they’re only for the wealthy or that it’s planning to fail, but that isn’t the case. Here’s everything you need to know about prenuptial agreements.

What’s a Prenuptial Agreement?

A prenuptial agreement, “prenups” for short, is a contract between the couple that details how finances and property will split should there be a divorce.

The couple creates this document before getting married to outline what belongs to them in the event of divorce. In other words, this contract protects both parties involved.

A prenup can expedite the divorce process, but a prenuptial agreement is for more than divorce–it helps a spouse know what to do should their spouse die.

Who Should Get a Prenup?

As previously mentioned, there’s a stigma about prenups that they’re only for the wealthy. In reality, they’re excellent documents for everyone, especially those with a lot of property, assets, and businesses.

Although most people can and should get a prenup, here are some descriptions of individuals who should get a prenuptial agreement.

Those Who Own Businesses

A prenup can protect your business during a divorce if you have a business before getting married.

In the prenuptial agreement, you can outline stipulations protecting the businesses from becoming the other spouse’s property. This protection level is beneficial when newlyweds have successful businesses on their own and want to keep them separated.

Those with Children from Other Marriages

Whether or not both spouses have children from previous marriages, it’s essential to consider and create a prenup if at least one person has a child.

If this description fits your situation, a prenup ensures your child receives their proper inheritance when you pass away.

If you pass away without a prenup in your new marriage and your spouse is alive, your assets, property, and inheritance will likely go to your spouse first, leaving your child(ren) with less than expected.

When One Spouse is Wealthier

A prenuptial agreement protects the assets of a wealthier fiancè. Should divorce happen in the future, a prenup protects the wealthier fiancè by ensuring they don’t lose their financial stability.

Additionally, a prenup with a wealthy fiancè ensures the couple isn’t marrying for money.

When One Spouse Accrued Debt Before Marriage

Even though spouses love each other, they keep some things secret–like massive amounts of debt. If you don’t sign a prenup before marriage, your spouse’s debt becomes yours.

A prenup can protect you from financial surprises and ensure you’re not responsible should your spouse die. Additionally, this contract can help curb your spouse’s spending habits if they know they’re responsible for the debt regardless of their marriage.

Conclusion

Prenuptial agreements are contracts that help you and your spouse establish financial boundaries in the event of divorce or untimely death.

Prenups are excellent options for people who own businesses, have children from other marriages, are wealthy, or have a fiancè with a lot of debt.

Estate planning is not only for the wealthy–it’s beneficial for all people, regardless of your estate’s size. With proper estate planning, you can save survivors time and stress after you pass by having your property and items organized and settled.

However, the internet is filled with advice columns on which documents you need and how to prepare them–it’s a little overwhelming.

At Hickey and Hull, we strive to make this process as simple and painless as possible. We’ve created this concise list of necessary estate planning documents to detail which ones you need and why they’re essential.

Start With a Will

A will is one of the most important documents you can ever create for yourself. A will protects your assets and helps your survivors after you’ve passed.

We strongly recommend that everyone creates a will once they turn 18. Even though some people may argue they don’t have enough money to justify a will, all it takes is having a few possessions, children, and pets to include in a will.

The best part about a will is that with the right team of attorneys helping you along the way, you can regularly update beneficiary designations to reflect your assets accurately.

Develop a Basic Trust

Trusts are excellent for helping you in times of need. Having immediate access to funds in a living trust can help you battle medical bills before they pile up and financially suffocate you.

When you pass, the funds in a trust don’t go through probate court, which simplifies the process for the executor.

Incur the Power of Attorney

Power of attorney is essential for someone to develop a will and trust. In the event you are incapacitated and can’t speak for yourself, you need someone you trust to speak for you who will carry out your wishes.

Work with attorneys to properly file the documents to ensure your chosen individual receives their power of attorney rights if necessary.

This step is more precautionary than anything, but it’s crucial to building a thorough estate plan.

Implement a Living Will

A living will is one of the final documents we recommend for all clients. Contrary to a will and trust, a living will states your wishes for medical professionals and the decisions they make should you be unable to voice your thoughts and wishes.

A living will is essential because it takes the stress and worries off your family members and loved ones. After all, you’ve already made the decision ahead of time.

Establish Durable Healthcare Power of Attorney

Although a living will is helpful for medical professionals, you need a healthcare power of attorney to speak on your behalf for matters not addressed in your living will.

A durable healthcare power of attorney is similar to a regular power of attorney, except they only focus on your medical needs and can make the tough calls.

Conclusion

Estate planning is arduous because it forces you to think about the end of your life, which isn’t pleasant. But this necessary planning is helpful for your loved ones when you pass because they can focus on mourning rather than legal paperwork. Contact Hickey and Hull Law Partners today to start the process of establishing your estate plan.